SECTION 1: Introduction — Why Sustainability Reporting Standards Matter Now

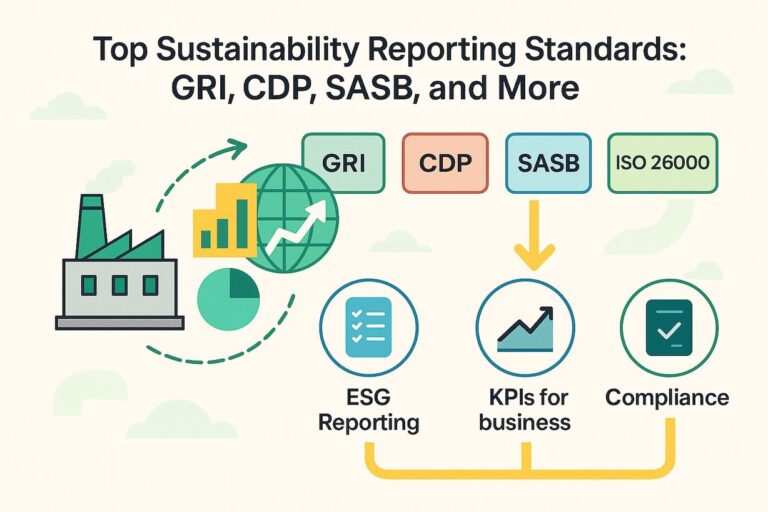

In today’s business landscape, sustainability is no longer optional—it’s strategic. Companies across sectors are under growing pressure from regulators, investors, and consumers to disclose their environmental, social, and governance (ESG) performance. But how exactly should this information be reported? Enter the world of sustainability reporting standards.

Sustainability reporting standards provide the structure, credibility, and comparability that modern businesses need to communicate their environmental and social impacts transparently. Whether your goal is regulatory compliance, stakeholder engagement, risk mitigation, or competitive differentiation, the right reporting standard acts as your blueprint.

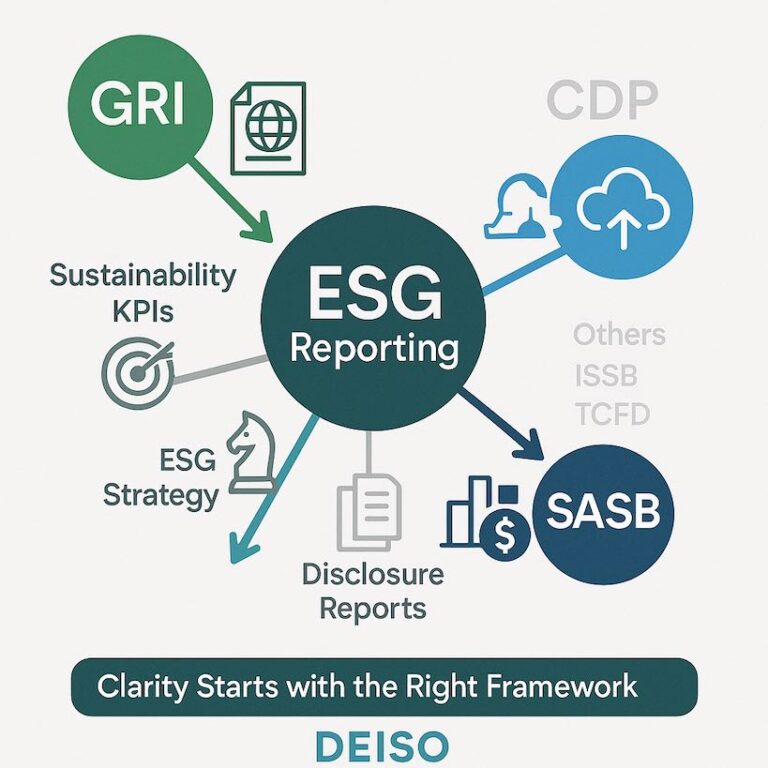

This article demystifies the top sustainability reporting standards used globally—including GRI (Global Reporting Initiative), CDP (Carbon Disclosure Project), and SASB (Sustainability Accounting Standards Board)—while also offering practical guidance on how to choose the right framework for your organization.

At DEISO, we help companies navigate, apply, and excel in sustainability reporting—through consulting, ESG dashboards, AI-powered analytics, and professional training. This article reflects our practical experience across industries, from manufacturing to infrastructure to logistics.

SECTION 2: What Are Sustainability Reporting Standards?

At their core, sustainability reporting standards are structured frameworks that define what, how, and when companies should report on ESG issues. These standards bring consistency and comparability to sustainability disclosures, much like financial standards do for accounting.

They answer critical questions such as:

-

Which environmental metrics matter most?

-

How should carbon emissions be categorized (Scope 1, 2, 3)?

-

What level of stakeholder engagement is necessary?

-

How do you ensure industry-specific materiality?

For example, GRI provides a broad, stakeholder-centric framework, while SASB focuses on financially material issues relevant to investors. CDP zeroes in on carbon and environmental data, aligning with climate action goals and investor disclosures.

These standards are not interchangeable—they serve different audiences and purposes. That’s why selecting the right one (or combination) is essential.

SECTION 2: What Are Sustainability Reporting Standards?

At their core, sustainability reporting standards are structured frameworks that define what, how, and when companies should report on ESG issues. These standards bring consistency and comparability to sustainability disclosures, much like financial standards do for accounting.

They answer critical questions such as:

-

Which environmental metrics matter most?

-

How should carbon emissions be categorized (Scope 1, 2, 3)?

-

What level of stakeholder engagement is necessary?

-

How do you ensure industry-specific materiality?

For example, GRI provides a broad, stakeholder-centric framework, while SASB focuses on financially material issues relevant to investors. CDP zeroes in on carbon and environmental data, aligning with climate action goals and investor disclosures.

These standards are not interchangeable—they serve different audiences and purposes. That’s why selecting the right one (or combination) is essential.

SECTION 3: Why Standards Like GRI, CDP, and SASB Are Vital for Business

Here’s what happens when a company doesn’t follow a recognized reporting standard:

Investors view ESG reports as vague and untrustworthy

Stakeholders can’t compare your performance against peers

Opportunities for sustainability-linked financing or procurement are missed

Conversely, companies using structured sustainability reporting standards benefit from:

Increased transparency and credibility with stakeholders

Improved risk management and ESG benchmarking

Readiness for regulatory shifts (e.g., CSRD in Europe, SEC climate disclosures in the U.S.)

Greater alignment with sustainability KPIs for business performance, which DEISO helps clients develop and track in real time

In short: standards transform ESG from a PR effort into a strategic advantage.

🟩 SECTION 4: Table – Side-by-Side Comparison of Sustainability Reporting Standards

Below is a side-by-side comparison of the most prominent sustainability reporting frameworks to help you understand how they differ across key dimensions:

| Criteria | GRI | CDP | SASB | TCFD |

|---|---|---|---|---|

| Focus Area | Broad ESG topics | Climate change, water, forests | Financial material ESG issues | Climate-related financial disclosures |

| Audience | Stakeholders (broad) | Investors, NGOs, policymakers | Investors | Investors, regulators |

| Industry Specificity | Yes (but broad) | No | Yes (industry standards) | No |

| Materiality Approach | Stakeholder-centric | Climate risk | Financial materiality | Risk and opportunity |

| Data Type | Qualitative & quantitative | Quantitative (GHG, water, etc.) | Quantitative + financial relevance | Quantitative + scenario analysis |

| Adoption Scope | Global | Global | U.S. origin, growing global use | Global |

| Regulatory Alignment | EU-focused, aligned with CSRD | Aligns with TCFD | U.S. SEC alignment potential | Mandated in several jurisdictions |

Use Case Example: A multinational manufacturer might combine GRI for stakeholder transparency, CDP for climate disclosures, and SASB for investor communication.

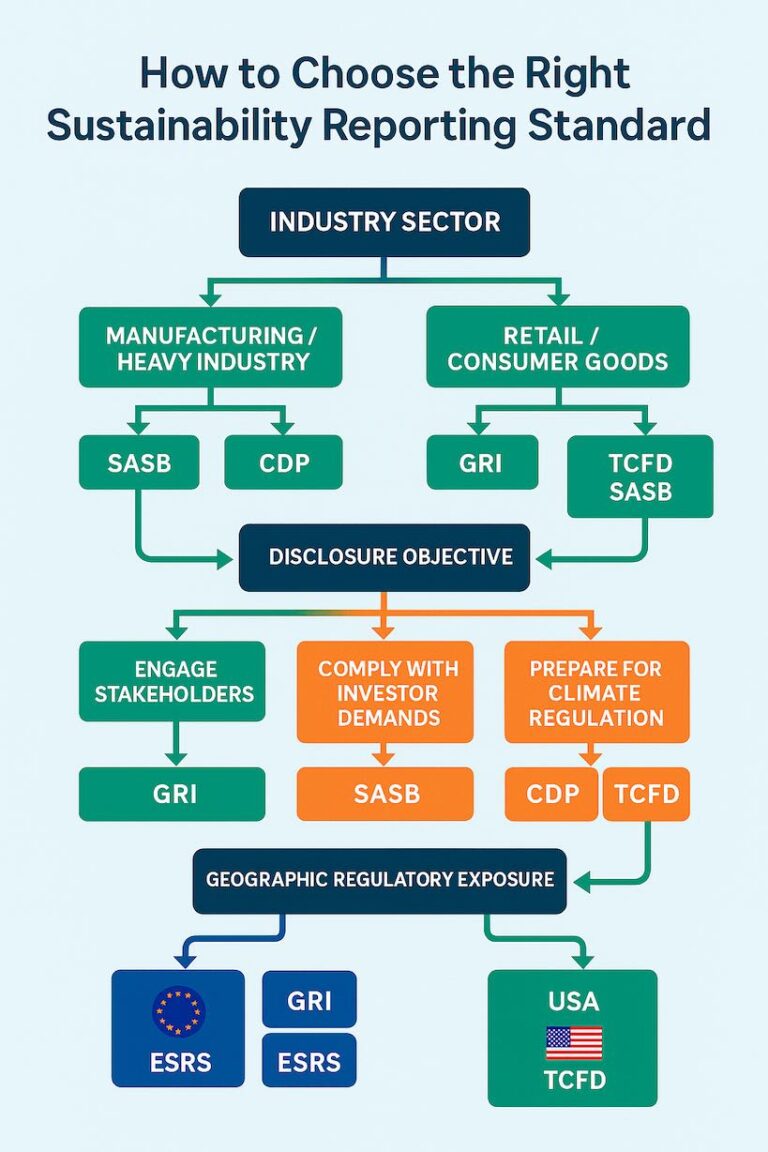

5: How to Choose the Right Sustainability Reporting Standard for Your Company

Choosing a sustainability reporting framework isn’t a one-size-fits-all decision. Below are key considerations:

✅ 1. Industry Sector

Manufacturing/Heavy Industry? → SASB + CDP

Retail/Consumer Goods? → GRI

Financial Services? → TCFD + SASB

✅ 2. Disclosure Objective

Engage stakeholders & build trust? → GRI

Comply with investor demands or stock listing? → SASB

Prepare for climate regulation or carbon tax? → CDP + TCFD

✅ 3. Geographic Regulatory Exposure

Europe (CSRD)? → GRI + ESRS

USA (SEC rules)? → SASB + TCFD

✅ 4. Digital Readiness

If your enterprise has digital tools or aims for real-time reporting, DEISO recommends integrating frameworks into AI-powered ESG dashboards for:

Automated Scope 1, 2, and 3 tracking

Instant performance benchmarking

Intelligent materiality mapping

Need help choosing and implementing your framework? DEISO offers consulting, training, and ESG system integration tailored to your industry and region.

6: Use Case – How Digital Twins Can Support ESG Reporting (Example Only)

Although not a framework themselves, digital twins can act as enablers for advanced ESG reporting. By creating a real-time virtual replica of a facility or supply chain, companies can:

Measure energy use and emissions in real time

Simulate sustainability scenarios (e.g., process improvements)

Collect automated data for Scope 1, 2, and 3 emissions

At DEISO, we combine digital twin technologies with AI to support our clients in automating ESG data collection—helping them meet both CDP and GRI reporting requirements.

7: Why DEISO Is Your Partner in Sustainability Reporting Success

Whether you’re just starting your ESG journey or transitioning to CSRD or SEC-aligned frameworks, DEISO is your strategic partner. Here’s what we offer:

💼 DEISO Services Aligned to ESG Reporting:

ESG & Sustainability Consulting: Framework selection, roadmap development, and stakeholder engagement strategy

AI-Enhanced ESG Dashboards: Custom-built platforms to automate, visualize, and optimize ESG KPIs

Premium Training Programs: Teach your internal team how to prepare, implement, and audit ESG reports across GRI, CDP, and SASB

Data Management & Verification: Lifecycle data capture, scope emissions calculation, and assurance support

We don’t just implement standards—we help you leverage them as tools for business growth and regulatory resilience.

8: Conclusion – Master the Standards, Lead the Change

Sustainability reporting standards are more than disclosure tools—they’re business tools. The right framework helps your organization build trust, meet compliance goals, attract investors, and grow sustainably.

Whether you align with GRI, CDP, SASB, or all three, your success depends on how well you implement, measure, and manage ESG data.

🔎 Looking for clarity and impact in your reporting strategy?

💬 Contact DEISO today to discuss your ESG goals and discover how our tools and expertise can power your next report.